At WhisperClaims, our mission has always been to help accountants and advisers prepare robust, compliant R&D tax relief claims with confidence.

That value has only become more important in recent years, as the landscape for R&D tax has changed dramatically:

Add to this the rise of AI and automation, and the question of whether or not to use software is the wrong question. The right question is whether your software can truly manage the risks and complexity of R&D tax.

Our answer is clear – navigating this space requires more than a template, it requires a framework.

Take just one decision point: choosing which R&D scheme to claim through.

Currently, there are six R&D schemes and up to nine possible claim routes. The right choice depends on interconnected factors such as:

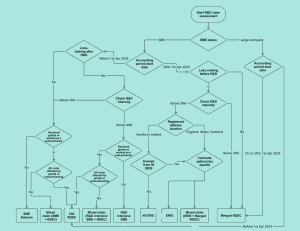

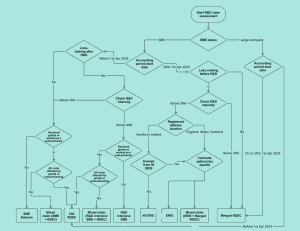

We’ve pulled this together into a flow chart (figure 1) and as you can see, it’s not a simple decision. It is, however, a decision that needs to be made correctly for every single claim. This is without even considering how to assess SME status, whether the claim is affected by the PAYE cap, whether the company meets the R&D intensive criteria…It’s a lot to remember and apply every time.

Figure 1: Flowchart showing how to decide which R&D tax relief scheme(s) can be utilised

WhisperClaims was designed, and continues to evolve, to manage this complexity, giving accountants a structured, repeatable process that ensures nothing is overlooked.

Importantly, WhisperClaims is not just software. Every subscription includes access to our Advice Line, where R&D tax experts act as a silent partner to your team, guiding you through grey areas, scheme queries, or eligibility challenges.

Before August 2023, there was no statutory requirement to submit a detailed report with an R&D claim. Today, the AIF makes robust documentation mandatory, and HMRC has signalled that scrutiny will remain high.

This is why firms using WhisperClaims have a competitive advantage: a platform designed around compliance, combined with expert human support, ensures that every claim is prepared to withstand enquiry.

WhisperClaims is more than just software – it’s a framework for compliance, risk management, and efficiency in R&D tax relief. Accountants save time while maintaining rigour. Clients gain confidence that their claims are defensible. Firms protect their reputation in a challenging, highly visible sector.

If you’d like to find our more about how WhisperClaims software and expert Advice Line support can help you prepare robust claims on behalf of your clients, whilst keeping you confidently on the right side of HMRC, why not book a demo?

Subscribe to email updates

© 2025 Wobbegong Technology Ltd (Registered number 10754811), trading as WhisperClaims.

WhisperClaims is a registered trademark of Wobbegong Technology Ltd (Trade Mark No.: UK00003360482).