The 2025 R&D tax relief stats were released on 30th September and make for interesting reading, especially for those in the sector who work with SMEs.

The overall picture is mostly negative, with a 31% drop in SME claims between 2022/23 and 2023/24. This means that the number of SME claims has dropped by over 52% since the 2020/21 claim year, compared to a 9% drop for RDEC.

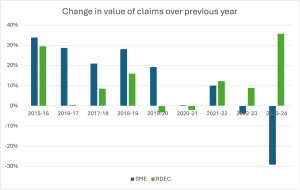

The statistics back up the gut feeling many of us in the sector suspected – the recent changes to the scheme have effectively led to a ‘transfer’ of benefit from small SMEs to large companies. The value of support given to SMEs in 2023/24 has dropped by 29% since 2022/23, whereas the support given through RDEC has increased by 36%. This is also reflected in the disproportionate reduction in smaller claims and increase in very large claims.

Overall though, the most striking point is that despite increased compliance and a reduction in SME benefit rates, HMRC has only reduced the total cost of the R&D tax relief scheme by around 2%.

This set of statistics is the first that really shows the impact of HMRCs changes and compliance behaviour over the past few years, and it’s very easy to see.

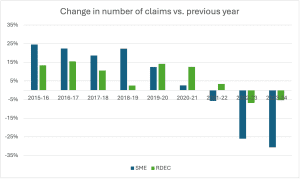

Looking at figure 1, we can see that the number of claims made under both schemes increased by around 20% year-on-year, until the 2019-20 claim year. This trend has since reversed, culminating in a 31% year-on-year reduction in SME scheme claims for 2023/24.

This drop can be directly attributed to HMRC’s compliance activity and subsequent changes made to the scheme. Claims made for 2020/21 and 2021/22 will have been directly impacted by the FIS letters sent out in summer 2022, and the ramping up of compliance checks. From 2022/23 onwards, the reduction in benefits and the introduction of the Additional Information Form (AIF) compounded this effect.

Figure 1: Reduction in the number of R&D tax relief claims made for claim year 2023/24 compared to the previous period.

Figure 2 shows how these changes in claim numbers have played out in terms of value. Unsurprisingly, the reduction in SME claim numbers has led to a proportionate fall in value. The RDEC profile looks very different, with the value of claims increasing throughout this period, jumping 36% in 2023/24, directly linked to the higher benefit rate available for expenditure incurred after 1st April 2023.

Alongside this, we’ve seen advisers and agents focussing more on larger claims, and the numbers suggest that large companies are carrying out more R&D in house.

Figure 2: Change in the value of R&D tax relief claims made for claim year 2023/24 compared to the previous period.

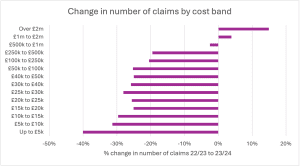

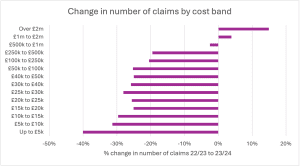

Looking deeper at claim profiles, figure 3 shows how the number of claims in each cost band changed between 2022/23 and 2023/24. The data highlights a significant fall in the number of claims delivering benefits of less than £15k, while claims worth over £1m have grown.

Figure 3: Changes in the number of R&D tax relief claims made by cost band for claim year 2023/24 compared to the previous period.

This ‘transfer’ of value from the small claim end to the large claim end explains why the reduction in overall cost of the R&D scheme is not proportionate to the reduction in the number of claims. It also reinforces the point that recent changes have favoured larger companies at the expense of smaller SMEs.

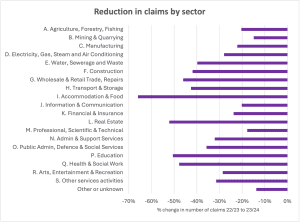

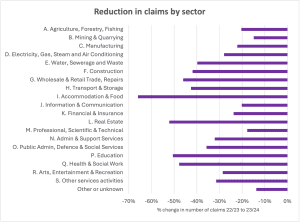

Finally, the statistics appear to point to one other effect of HMRC’s increased compliance activity – significant reductions in the number of claims made by companies operating in less technical sectors, year-on-year.

As figure 4 shows, all sectors saw a decline in claim numbers, but non-technical sectors were hit hardest. For example, claims in the accommodation and food sector fell by 66%, and in real estate by 52%. This suggests that the sector-based targeting of claims for compliance activity has been somewhat effective.

The 2025 statistics confirm what many in the sector had anticipated – a sharp reduction in SME claims, an increase in large claims and a marked shift in value towards large companies. While HMRC’s interventions have changed the profile of R&D tax relief, the overall cost of the scheme has barely moved. This suggests that the policy has reshaped where support is allocated rather than reducing government spend.

The coming years will reveal whether the merged scheme stabilises these trends or accelerates them further. The challenge ahead must be to ensure that innovation at the SME level – where so much economic growth begins – is not lost in the process.

We’ll continue to share analysis as the picture develops. In the meantime, our ebook on the Merged RDEC Scheme breaks down the new rules and what they mean in practice – you can click the button below.

Subscribe to email updates

© 2025 Wobbegong Technology Ltd (Registered number 10754811), trading as WhisperClaims.

WhisperClaims is a registered trademark of Wobbegong Technology Ltd (Trade Mark No.: UK00003360482).